Weekly Digest: 15 Sept 2025

Macro News and 3 stocks to watch

Macro News to watch this week:

The Federal Reserve should make a long anticipated 25 bps cut on Wednesday. The market is pricing in a 94% probability as can be seen here: Fed Watch Tool

They have said they are going to focus on the unemployment part of their mandate for now, as they believe the inflation issue is under control. Hedgeye Research, which I subscribe to, are expecting inflation to slowly increase into the back end of the year. This means that expectations for further cuts at the end of October and the middle of December could be unjustified. Currently the market puts a 77% probability of December seeing a target rate of 3.25% – 3.75%. That would be meaningfully lower than the current 4.25% - 4.5% and likely requires a lot of bad news on the jobs market.

The Bank of England also makes a rate decision on Thursday – no change is expected (so holding at 4%)

UK employment data is out on Tuesday and UK inflation on Wednesday. Core CPI is expected to be 3.7%.

This is not an exhaustive list of all macro news out this week, just the main ones.

Market View

I don’t have a strong view on market direction at present. The underlying narrative to the market seems to be that the US will run the economy hot, and monetary debasement trades are popular as a result (see the performance of gold)

My portfolio remains fully invested in equities, mostly in small caps, where stock specific risk is high. I don’t aim to track a global small cap benchmark, but that would be the most appropriate benchmark should I ever feel the urge to show off (hopefully).

Stocks:

Three stocks that are top of mind right now:

Nektar Therapeutics

Purecycle Technologies

Alphamin

Note: the best way to search for news and debate on these stocks with Twitter/X is by searching the ticker e.g. $NKTR

If the results get too messy (thanks to spam accounts) add a space then ‘min_faves:2’ to help cut out the spam, which doesn’t normally receive 2 or more likes per post.

Nektar Therapeutics ($NKTR)

The health care and biotech sectors have lagged the broader market this year so far, so I’ve been spending some time looking at a few stocks in this area. Nektar is one of two I hold.

This stock is moving now. It had three consecutive days of double-digit returns last week, on the back of a competitor’s drug producing disappointing trial results.

Market cap is just under $1 billion. It’s held by a couple of very good healthcare investors. A detailed write up was done by a Twitter/X user using the handle: @A_May_MD

His detailed write-up is here: Nektar Write Up

I was really impressed to find such a comprehensive piece of research, and it shows how the world of equity research is evolving. I note, he has also had success recently with another biotech stock ($ABVX)

The author makes a compelling case that their Rezpeg treatment has had very good results in trials so far, and the market for Atopic Dermatitis (also known as atopic eczema) is substantial.

I don’t normally invest much in the healthcare sector as I lack the specialised knowledge, so this was a small position initially. It has since grown to over 5%. I’m continuing to let it run, as they present trial results to a healthcare conference on Thursday (the 18th of September) and they could reach an out of court settlement payment anytime soon (read the detailed write up referenced above for details)

From a portfolio construction standpoint, I like the low correlation the stock will have to the rest of my portfolio. If the US economy does slow, to the point of recession, less economically sensitive stocks with a lot of stock specific risk like NKTR should still hold up reasonably well.

The stock is available on most UK stockbroking platforms, as is PCT below…

Purecycle Technologies ($PCT)

This is my biggest position.

It’s a stock I’ve followed for three years now, since I heard Mike Taylor describe it on a Hedgeye presentation. The potential here, is significant and long lasting.

They have a new way of recycling plastic (polypropylene) called dissolution technology. The technology was originally developed by Procter & Gamble and licensed to Pureycle.

With hindsight, the company probably went public a bit too early (via SPAC in 2021). It had covid-related delays constructing their first plant as well as engineering challenges.

At this point, they report they are reliably running at 87% of the plant capacity and still improving.

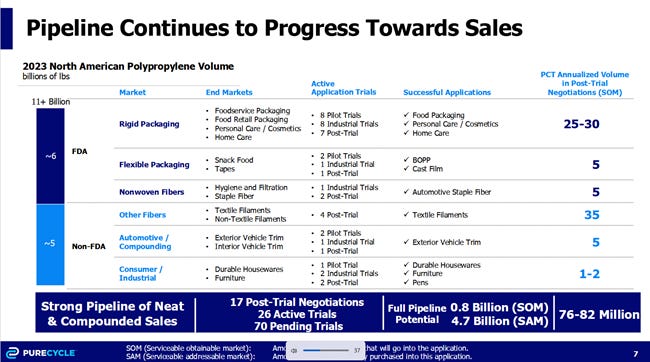

In their second quarter earnings, they stated they were in 17 post-trial negotiations – meaning purchase orders should be forthcoming. The relevant slide is below. For reference, expected pricing for their product is circa $1.36 per lb.

I believe investors are still in wait and see mode after being disappointed by the time taken to get the first plant up and running – hence purchase orders coming through could be a meaningful catalyst.

The company is also guiding to break even by the end of Q4 or Q1 2026. This would be another milestone for investors to tick off.

I will do a longer write up on the company soon, and what I like about it. For now, I eagerly await news of purchase orders.

Valuation is never an exact science, and where we have a company like PCT at such an early stage it’s even less exact.

The way I’m thinking about it, is the company has a target of $600m EBITDA by 2030. Putting that on a 30x multiple gives a market cap $18b. Discounting back 5 years at 20% give $7.2b.

As the current market cap is $2.4b, I’m not even considering trimming the position until some of that upside is realised.

The 30x multiple might sound expensive, but given the expected margins and growth rates, I actually suspect it will turn out conservative.

Plenty of risk exist in the execution though, so it’s one to watch closely.

Additional Information:

Check the company website and the excellent Reddit group:

https://www.reddit.com/r/PureCycle/

Alphamin ($AFM.V)

Canadian listed mining company. They operate a tin mine in the DRC, so usually a description that puts people off!

Tin is a metal that goes under the radar of most investors – most likely because there’s only 2 or 3 listed tin producers globally (Metals X is the other I follow, based and listed in Australia)

It is used in a lot of applications, the most memorable for me, is that it’s used to produce solder. The ‘glue’ that holds circuit boards together.

The mine has the highest-grade tin deposits in the world. It operates at the lowest-cost quartile of the global tin producer complex.

Global demand for tin is in the region of 376,300 tonnes and is expected to grow at 2-3% every year. Alphamin produce 20,000 tonnes a year, meaning they are circa 5% of global supply.

Given the current geopolitical backdrop, I expect the US is aware of the importance of Alphamin and its mine. Most global supply comes from China, Indonesia, Myanmar and Peru (70 – 80%).

When the civil war in the DRC caused Alphamin to shut down production in March & April for roughly five weeks. It’s not entirely clear what action the US took diplomatically, but the M23 rebels withdrew from the area, and I note media stories about a potential peace deal being signed this month (the 23rd of September has been mentioned).

The security risk is what has prevented me from investing before, despite having followed from afar for 3 years. Having seen how quickly it got resolved earlier this year, I feel comfortable with a position in the stock.

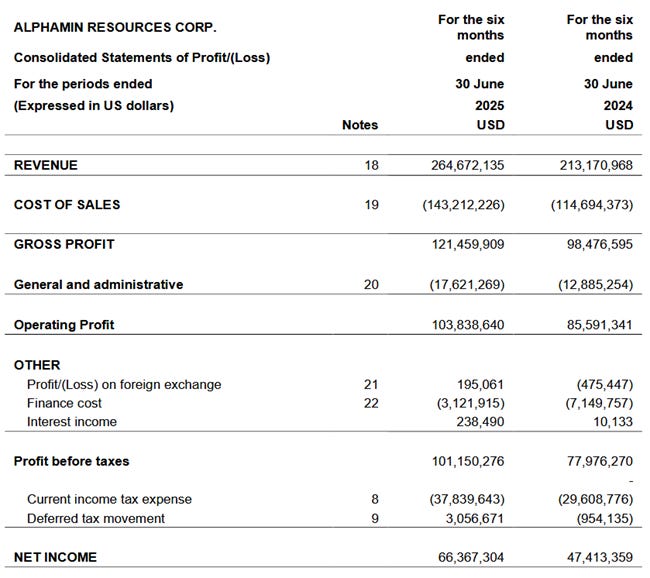

Moving onto valuation, here is a screenshot of the Income Statement from the latest update

The market cap in USD is $900m. If we take the last six months net income figure and double it to get a back of the envelope annual profit estimate, then Alphamin sits on a P/E of 6.7x

This six-month period includes the time when the mine had to shut down for security reasons.

The balance sheet is strong, and there is the possibility of exploration results leading to a resource upgrade.

They pay a 7 cents (CAD) semi-annual dividend today (the 15th). Friday’s closing stock price was 0.97 CAD for reference. So, we are looking at a 14% dividend yield, with the company mentioning the possibility of a special dividend in November as well.

I think the risk/reward here is good. If the price shot up to $1.5 tomorrow for some reason, I’d be reducing the position, and if it hit $2, I’d probably be out. For now, I’m happy to hold.

As with Nektar Therapeutics, the risk (in this case jurisdiction risk) means position sizing is important. In my 100% equity portfolio, this would be between 2.5% and 5%.

The stock is not available to buy on platforms like Hargreaves Lansdown, who don’t have great coverage of Canadian stocks. It is available on Saxo Markets and interactive investor for both ISA and SIPP accounts.

All three stocks have potential catalysts in the very near term. I look forward to updating as needed.

As a reminder, nothing here is financial advice. This is purely for information purposes only.